Mumbai money diaries from 1999.

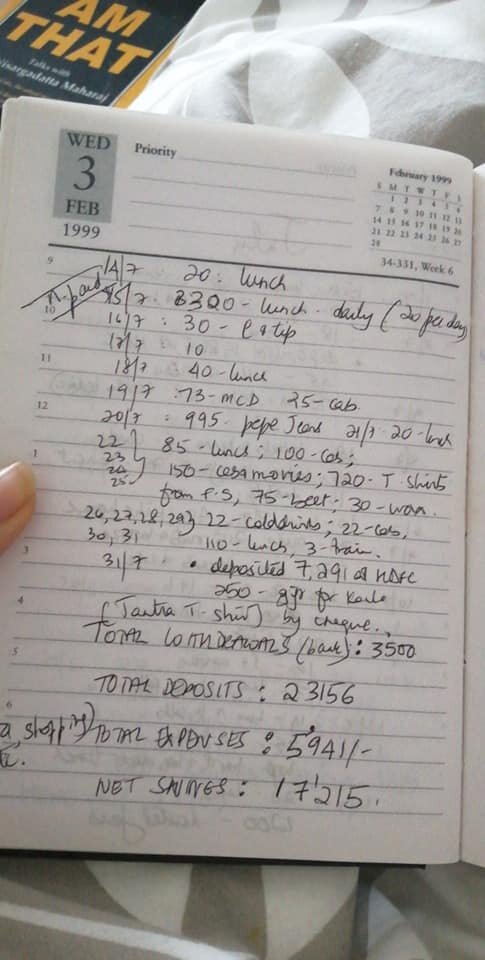

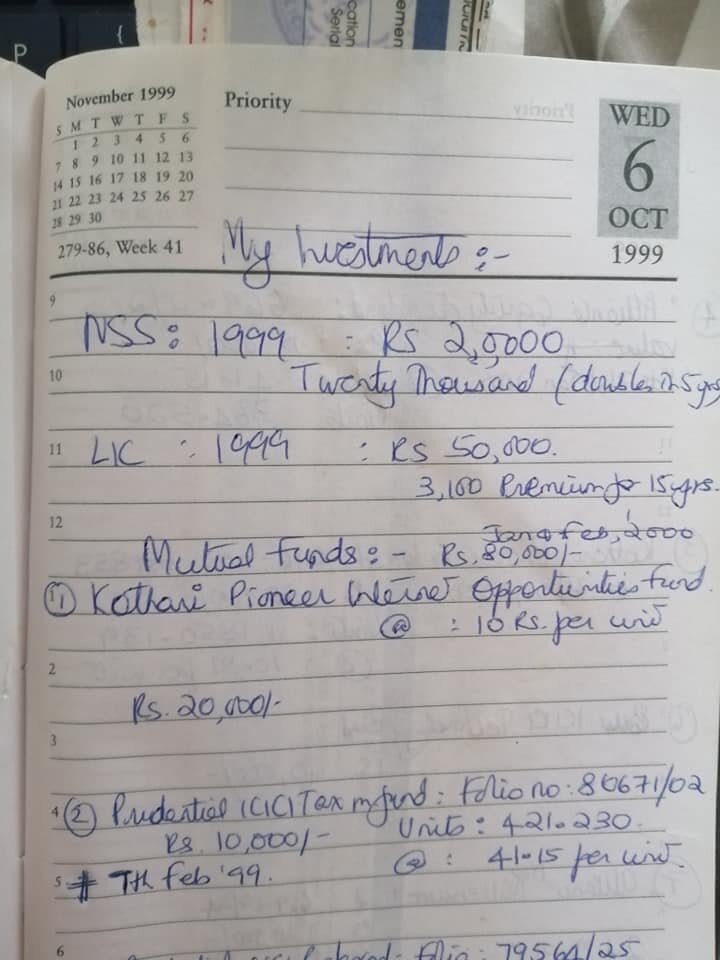

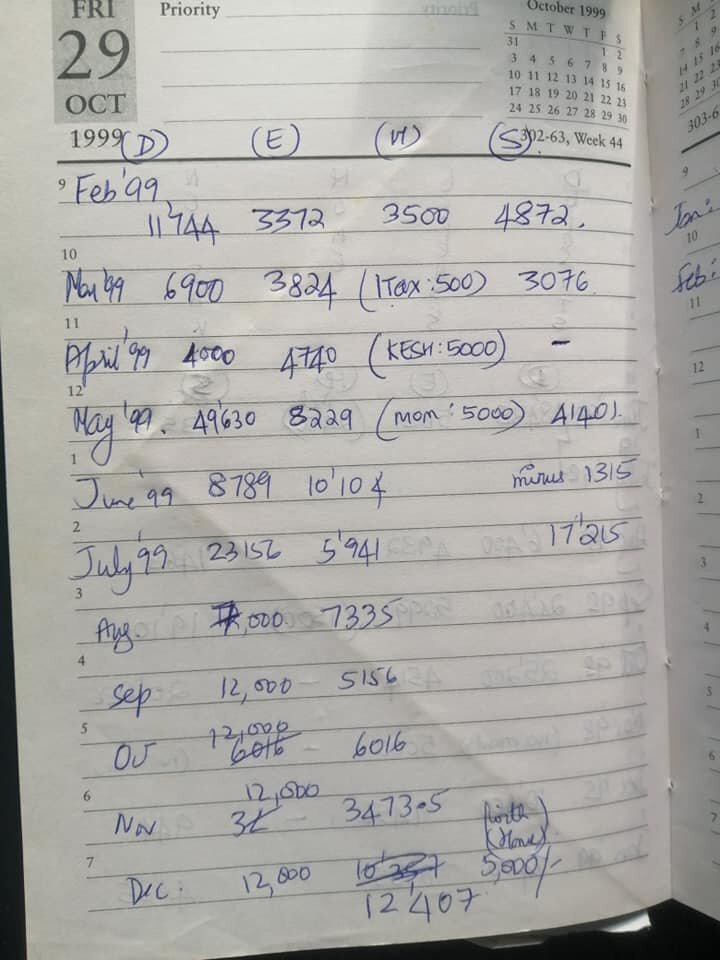

Back then, I think I earned 6,000 rupees (£70) as salary a month plus sales commissions. 4 rupees bus fare was an entry worth noting. £1 is roughly 92 rupees. I carefully noted four columns: D, E, H & S for bank deposits, expenses, home for money I sent home and savings. The savings column I then invested in mutual funds. My investing endeavours were soon followed by a great stock market crash which taught me painful, but valuable early lessons in investing.

I also lived in a 17-bedroom dormitory, in a lovely part of Mumbai. I did my best to escape daily night rosary prayers by standing still on the western toilets around 8 pm; the nuns were kind enough to leave us alone if they couldn’t easily find us. My hostel warden, a warm and scary South Indian, who was very unimpressed with my Goan shorts-wearing habits, still runs the place at Mount Mary’s Bandra.

I was one of the ‘high’ earners there so the nun pestered me to leave; I ignored her as long as I could. Working women’s hostels in Mumbai weren’t easy to get in even if you flaunted your Roman Catholic background. Yet, some of the girls earned only around 2,000 rupees (£20) a month so the warden was being honest and fair. I never told the warden about my sales commissions for selling the ‘Honda City’ in the ‘Ichibaan Honda’ showroom in Mahalaxmi, Mumbai.

Hostel accommodation included breakfast and dinner; it was 600 rupees a month (£8) and reasonable at 10% of my wages. Breakfast was always a loaf of bread with a paper-thin omelette and a mug of tea including on weekends. Dinner was some sort of curry, rice and vegetable for which I always wore my gloriously short shorts; I didn’t see the point of modesty in an all-girl living situation. Life in the hostel was surprisingly harmonious considering we almost lived on top of each other.

Makes sense then that I love the philosophy of a book called ‘Your Money or Your Life’ which I first read in 2015. The first step recommended is careful record keeping!

Do you keep careful records? Did you ever… At a time when skinter? Do you conscientiously cut out expenses that bring you no fulfilment and splurge on expenses that do? Are you interested in Financial Independence so you no longer have to swap your life energy for money and work is optional?

Please tell me you have heard of Mr Money Moustache. His blog will advance your financial literacy & quality of life profoundly.